How Risk Moves

Financial shocks rarely stop at a single entity - they travel through the networks which connect clients, counterparties, and infrastructures.

Network & Structural Risk (NSR) captures the risk dynamic for a client, and how it may propogate across other clients through connections and relationships.

Working together with entity client lifecycle management (E-CLM), network & structural risk (NSR) forms the analytical half of client network risk management (CNRM), giving banks visibility of their risk exposures and how risk moves through the financial and business system for their client population.

NSR is underpinned by an entity-role-relationship (ERR) data structure.

What Network & Structural Risk (NSR) Does

NSR examines how the structure of a bank’s and its client’s networks influences resilience.

It combines structural mapping, network analytics, and operational dependency tracing to reveal where vulnerabilities and concentrations sit across the client population.

Why Network & Structural Risk Matters

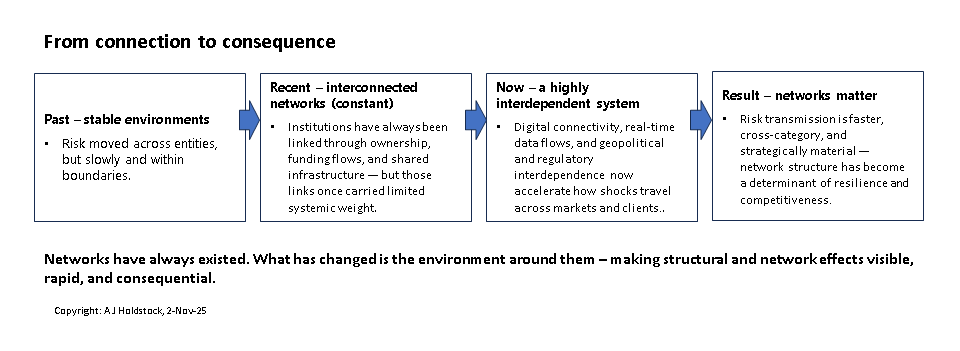

Risk has never been confined to single entities or neat categories.

What has changed is the speed, reach, and consequence of how risk moves through today’s interconnected financial and commercial systems.

Digital connectivity, regulatory complexity, and geopolitical fragmentation now make network effects material to resilience and competitiveness

Without NSR insight, banks face:

Hidden network exposures — indirect links through shared service providers, intermediaries, or ownership structures.

Regulatory and reputational cascades — a single breach or sanction spreading through connected parties.

Operational fragility — vendor, technology, or jurisdictional concentration amplifying local failures.

Strategic drift — globally connected clients shifting toward institutions that manage network risk more effectively.

With NSR, banks can:

Detect and quantify inter-client and inter-jurisdictional dependencies before they become systemic.

Strengthen governance and control frameworks with structural evidence.

Inform strategic decisions on client coverage, market focus, and resource allocation based on network resilience.

Structures and Networks NSR Examines

NSR focuses on the structures that define how risk forms and the networks through which it moves.

Together, they describe the operating environment within which clients and the bank interact.

From Entity-Centric to Network-Aware Risk Management

Traditional risk frameworks manage exposures within defined categories and entities.

NSR extends this by analysing how structural and network linkages transmit risk across those categories.

CNRM builds on NSR to integrate client relationships and response mechanisms.

Together they evolve the ERMF from entity-centric to network-aware, adding the structural insight needed for modern resilience.

The Data Architecture Behind NSR and CNRM

Both Network & Structural Risk (NSR) and Client Network Risk Management (CNRM) depend on a consistent data architecture that can represent entities, their roles, and their relationships.

This structure — the Entity-Role-Relationship (ERR) model — provides the foundation that turns operational data into connected insight.

By aligning client, counterparty, and ownership data to the ERR model, a bank can see not just individual clients but the structures and networks linking them.

That visibility enables NSR to trace how risk propagates, and allows CNRM to coordinate mitigation and decision-making across the network.

ERR is the structural foundation that makes network-aware risk management possible.