The Next Evolution of Client Risk Management

Client Network Risk Management (CNRM) extends Entity Client Lifecycle Management (E-CLM) to the network level — enabling banks to see, assess, and act on risk across connected clients, counterparties, and jurisdictions.

From Entity to Network Awareness

Traditional CLM systems manage client entities. CNRM expands this to manage the client’s network — the entities, roles, and relationships through which real-world risk moves.

It unites operational, data, and risk disciplines so banks can recognise exposures, dependencies, and opportunities across connected clients

The CNRM Capability Stack

5 layers make up the capability stack for client network risk management:

Foundation — Purpose and Governance

Defines why the bank needs network-level awareness and the principles that guide its design.

Structural — Data and Classification

Establishes the Entity-Role-Relationship (ERR) data architecture, taxonomies, and controls that link clients across systems and jurisdictions.

Operating — Processes and Integration

Runs the core client lifecycle, ingesting and maintaining network data within onboarding, KYC, and ongoing due diligence workflows.

Execution — Monitoring and Control

Applies analytics, screening, and workflow oversight to detect and respond to network risks in real time.

Outcome — Resilience and Insight

Delivers network-aware risk decisions that strengthen compliance, operational efficiency, and client trust.

The CNRM Capability Stack

5 layers make up the capability stack for client network risk management:

Foundation — Purpose and Governance

Defines why the bank needs network-level awareness and the principles that guide its design.

Structural — Data and Classification

Establishes the Entity-Role-Relationship (ERR) data architecture, taxonomies, and controls that link clients across systems and jurisdictions.

Operating — Processes and Integration

Runs the core client lifecycle, ingesting and maintaining network data within onboarding, KYC, and ongoing due diligence workflows.

Execution — Monitoring and Control

Applies analytics, screening, and workflow oversight to detect and respond to network risks in real time.

Outcome — Resilience and Insight

Delivers network-aware risk decisions that strengthen compliance, operational efficiency, and client trust.

CNRM builds on E-CLM

E-CLM provides entity integrity, process control, and compliance efficiency.

CNRM extends it — connecting entities and enabling the bank to manage risk and opportunity through network-level intelligence.

Client Network Risk Management (CNRM) integrates data from CLM, risk, and operations into a single structural control capability for the financial institution.

Why It Matters

In an era of fragmented global value chains, client risk is network risk.

Banks that can interpret client networks can foresee contagion, anticipate stress, and strengthen their global relevance.

Without it, they face rising operational blind spots, fragmented risk coverage, and potential client attrition to more network-aware competitors.

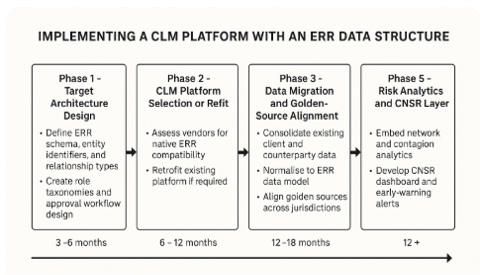

Implementing CNRM

Assess the existing CLM platform readiness for ERR-based architecture

Define the data model and taxonomy for entity-role-relationship

Integrate network analytics and external data sources

Align governance and operating model

Establish a five-year transformation roadmap

Implementing CNRM is a significant journey with the following suggested as starting points.